The recent collapse of Silicon Valley Bank has sent shockwaves through the entrepreneurial landscape, particularly impacting entrepreneurs of color. With billions being withdrawn in a single day, the sudden loss of a major financial institution has exacerbated existing funding inequalities in the banking sector. SVB was known for its commitment to minority entrepreneurs, providing essential financial support and resources that were often hard to come by. As industry experts point out, this event underscores the severe disparities for entrepreneurs, demonstrating how systemic bias in funding practices can disproportionately affect people of color. The Silicon Valley Bank collapse has reignited crucial conversations about the need for robust minority entrepreneurs support and innovative solutions to counteract business funding inequality.

The recent downfall of a prominent tech lender in California has highlighted critical challenges facing underrepresented business founders, especially those from diverse backgrounds. This event not only created immediate uncertainty for startups reliant on its services but also raised alarms over the ongoing funding disparities that plague the entrepreneurial ecosystem. With venture capital commitments now under scrutiny, many industry advocates are calling for bolstered initiatives aimed at empowering minority business owners. The fallout from this banking crisis showcases the urgency of addressing financial inequities and supporting diverse entrepreneurial ventures. As stakeholders assess the long-term impact of this collapse, there is a growing focus on fostering an inclusive environment that offers equitable access to essential resources for all entrepreneurs.

Impact of the Silicon Valley Bank Collapse on Minority Entrepreneurs

The Silicon Valley Bank collapse has sparked significant concern among minority entrepreneurs, as this institution was a vital source of funding and support for underrepresented business owners. Many in the community feared that the bank’s downfall signals a broader tightening of capital access for entrepreneurs of color. Venture capitalist Arlan Hamilton has pointed out that the support provided by SVB was crucial. Entrepreneurs faced by economic storms often come from disinvested backgrounds, making the loss of a supporter like SVB even more catastrophic. The bank was not just a financial institution; it represented hope and opportunity in a funding landscape that has historically marginalized people of color.

As investors pull back and lending standards tighten in the wake of this financial crisis, minority entrepreneurs may find themselves in a precarious position. Statistics highlight disproportionate barriers; Black-led startups were granted only 16% of the funds they sought, a stark contrast to their White counterparts. This discrepancy showcases a systemic issue within the banking sector, exacerbated by the failure of a major bank like Silicon Valley Bank. The situation demands urgent attention to create equitable solutions that ensure funding flows to all entrepreneurs, regardless of color.

Addressing Business Funding Inequality

Business funding inequality remains a pressing issue, especially within the context of recent financial disruptions like the Silicon Valley Bank collapse. Minority entrepreneurs are calling for reforms to address the disparities that have long existed in access to capital. With traditional banks often reluctant to lend to businesses run by people of color, alternative funding sources are critical. Community banks and microfinance institutions can offer important support, helping bridge the funding gaps that minority entrepreneurs face. Enhanced loan programs focused on equity can be lifeblood for emerging businesses, fostering innovation and sustainability.

To effectively tackle the funding inequality, policies need to be established that incentivize lending to historically marginalized groups. This includes creating grants and funding programs specifically designed for minority entrepreneurs and reinforcing partnerships with local organizations that understand the community’s needs. Furthermore, encouraging investment in minority-led businesses by larger financial institutions can create a more equitable financial ecosystem, where entrepreneurs of color can thrive. Efforts to provide financial literacy education and resources will also empower these entrepreneurs, equipping them with the tools they need to succeed in a competitive market.

The Role of Community Banks in Supporting Entrepreneurs of Color

In the aftermath of the Silicon Valley Bank collapse, community banks have emerged as crucial pillars for supporting entrepreneurs of color. These institutions often have a deeper understanding of the unique challenges faced by marginalized business owners and can offer tailored financial products that align with their needs. By focusing on relationship banking rather than traditional credit scores, community banks can give these entrepreneurs a fair chance at securing needed funding. Their commitment to local economies can foster economic inclusion, empowering minority entrepreneurs to innovate and grow.

Moreover, community banks often prioritize outreach and education, helping aspiring business owners navigate the complexities of starting and managing a business. Initiatives like workshops on financial management, mentorship programs, and networking events are vital in cultivating an ecosystem where minority entrepreneurs can thrive. As they step into the gap left by institutions like Silicon Valley Bank, community banks can ensure that the aspirations of entrepreneurs of color are not only heard but supported with the right financial resources.

Innovative Funding Solutions for Underrepresented Entrepreneurs

In light of the Silicon Valley Bank crisis, innovative funding solutions are desperately needed to support underrepresented entrepreneurs. Fintech companies have started to play a pivotal role in bridging the funding gap, providing faster, more accessible options for entrepreneurs of color. Utilizing technology, these platforms can analyze alternative data signals to offer loans and funding that traditional banks might overlook. This represents a significant shift towards inclusiveness in business financing, allowing a wider array of entrepreneurs to access critical capital.

Additionally, crowdfunding platforms and social entrepreneurship initiatives are gaining traction as effective fundraising alternatives. These models not only democratize access to capital but also foster community engagement and investment. By empowering local communities to support their entrepreneurs, these innovative solutions can combat the systemic funding disparities that persist. As we rethink the future of business funding, it is imperative to include diverse voices and stories, ensuring that the growth of all entrepreneurs contributes to a more equitable economy.

Calls for Policy Changes in the Wake of Funding Disparities

The collapse of Silicon Valley Bank has reignited calls for critical policy changes aimed at addressing funding disparities affecting entrepreneurs of color. Advocates emphasize that for genuine equity to be achieved, policymakers must implement laws that mitigate discriminatory lending practices in the banking sector. This includes monitoring lending patterns and ensuring that minority-owned businesses receive equitable treatment in loan approvals. Supporting legislative measures that prioritize access to funding for underserved communities is essential in creating a more just economic landscape.

Additionally, government initiatives that provide financial incentives for banks to lend to minority entrepreneurs can help mitigate the funding inequality exacerbated by the bank’s collapse. Establishing public-private partnerships aimed at fostering financial education and supporting business development in communities of color is also critical. By investing in programs that enhance the skillsets of minority entrepreneurs, we can create a pipeline of successful businesses that contribute to local economies and resilience against financial crises.

The Importance of Social Capital for Minority Entrepreneurs

Social capital plays an essential role in the success of entrepreneurs of color, particularly in the aftermath of the Silicon Valley Bank collapse. Many minority business owners rely on networks of mentors, peers, and community leaders to navigate the complex landscape of entrepreneurship. These connections can provide not only moral support but also important referrals and advice on accessing funding. Building a robust support network is crucial for minority entrepreneurs, helping them overcome barriers that have historically hindered their success.

Organizations that focus on connecting minority entrepreneurs with influential networks can also create pathways to opportunities. Networking events, workshops, and conferences specifically designed for entrepreneurs of color facilitate collaboration and resource-sharing among these business owners. As they build social capital, these entrepreneurs can leverage their networks for fundraising and business development, critical components in sustaining their businesses amid uncertainties. The resurgence of community-driven support is key in ensuring that minority entrepreneurs can thrive despite systemic challenges.

Mitigating Economic and Racial Inequality Post-Collapse

In the wake of the Silicon Valley Bank collapse, addressing economic and racial inequality has become more urgent than ever. Experts assert that systemic issues within the financial system have long left minority entrepreneurs vulnerable to economic downturns. To mitigate these effects, a multifaceted approach is required—one that encompasses not only access to capital but also comprehensive support services. Community organizations, financial institutions, and government agencies must collaborate to create tailored solutions that lift up entrepreneurs of color and dismantle persistent barriers.

Policies that specifically target the economic disparities faced by minority business owners, such as tailored grant programs and accessible credit options, are crucial in stemming the tide of inequality. Additionally, fostering partnerships between community lenders and larger financial institutions can amplify efforts to promote equitable lending practices. By actively investing in the economic empowerment of underrepresented groups, we can address the inequalities brought to light by the collapse of institutions like SVB and work towards a more inclusive economic future.

Exploring Alternative Financing Options for Entrepreneurs of Color

As the ripple effects of the Silicon Valley Bank collapse continue to unfold, entrepreneurs of color are increasingly turning to alternative financing options. Traditional banks often have strict criteria that can disadvantage minority-owned businesses; therefore, exploring non-traditional lending avenues is essential. Options such as peer-to-peer lending, community development financial institutions (CDFIs), and impact investing are gaining popularity as viable routes for securing necessary funding.

These alternative financing solutions often come with more flexible terms and a better understanding of the unique challenges faced by entrepreneurs of color. Furthermore, many alternative funding options prioritize social impact alongside financial return, aligning with the values of diverse business owners. As more entrepreneurs leverage these innovative financing models, it becomes possible to build a sustainable future where access to capital is equitable, allowing entrepreneurs of color to thrive in competitive markets.

Looking Forward: A Unified Effort for Entrepreneurial Equity

The collapse of Silicon Valley Bank has prompted a unified call for action within the entrepreneurial community. There is a growing recognition that bridging the funding gap for minority entrepreneurs requires collective efforts among various stakeholders—financial institutions, government bodies, and community organizations must work in concert to create comprehensive solutions. Stakeholders must prioritize initiatives that promote inclusivity and provide consistent support to minority-owned businesses.

In the future, successful entrepreneurial equity will hinge on a commitment to dismantling systemic barriers and fostering an inclusive environment that empowers diverse leaders across industries. By leveraging collaborative impact, we can reshape the funding landscape, ensuring that all entrepreneurs, regardless of their racial background, have access to the resources necessary for their success. The dialogue sparked by the Silicon Valley Bank collapse can serve as a catalyst for meaningful change, and it is imperative that we act decisively to create an equitable future.

Frequently Asked Questions

What is the Silicon Valley Bank collapse and its impact on funding for entrepreneurs of color?

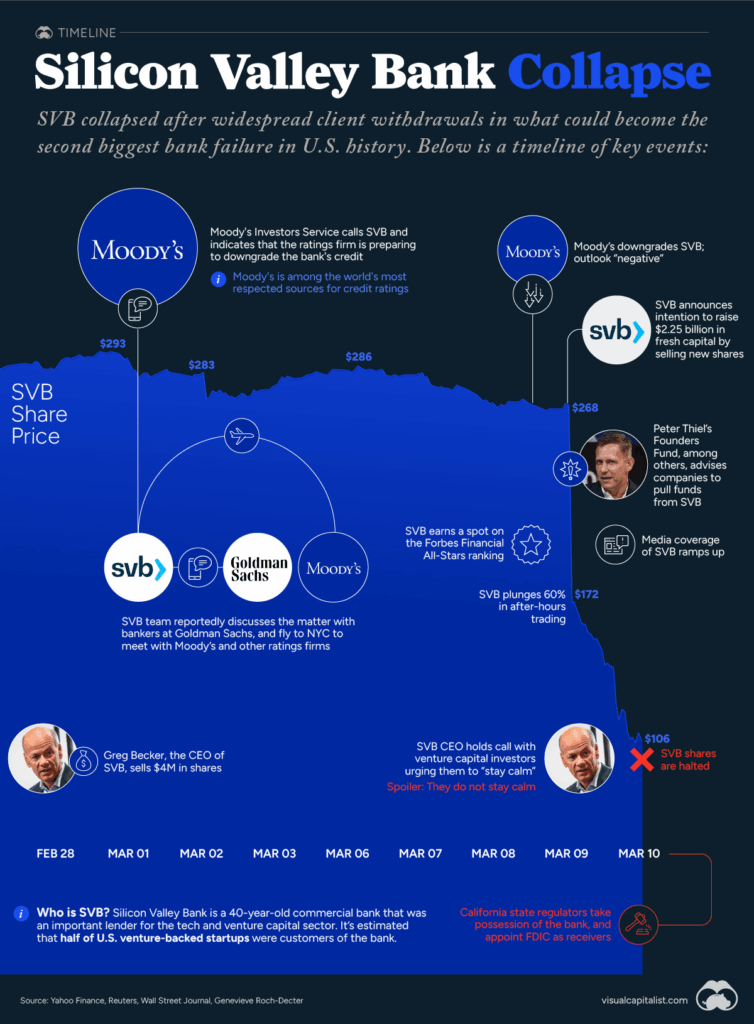

The Silicon Valley Bank collapse, which occurred on March 10, 2023, after a massive bank run led to over $42 billion in withdrawals, has raised significant concerns regarding funding for entrepreneurs of color. SVB was known for its commitment to supporting minority entrepreneurs through targeted funding and resources. Its failure leaves a gap in the financial support vital for these communities, exacerbating existing disparities in business funding.

How does the Silicon Valley Bank impact expose funding inequalities in the tech industry?

The Silicon Valley Bank collapse has highlighted the funding inequalities within the tech industry, particularly for minority entrepreneurs. Data indicates that Black-led businesses face significant hurdles in securing loans compared to their White counterparts. SVB’s commitment to serving underrepresented communities was unprecedented, making its failure indicative of broader systemic issues in access to capital.

What are the disparities for entrepreneurs of color highlighted by the collapse of Silicon Valley Bank?

The collapse of Silicon Valley Bank has intensified awareness of the disparities faced by entrepreneurs of color. Many minority business owners heavily relied on the bank’s funding and resources. With SVB’s absence, these entrepreneurs must navigate a challenging landscape of discriminatory lending practices that make it harder for them to secure funding, thus widening the equity gap in entrepreneurship.

What support options exist for minority entrepreneurs after the collapse of Silicon Valley Bank?

Following the collapse of Silicon Valley Bank, many minority entrepreneurs are looking toward community banks and fintech companies to fill the void left by SVB. These alternative financial institutions are increasingly focusing on providing equitable access to funding for marginalized groups, offering a lifeline to those affected by the collapse and the systemic funding inequalities in place.

How did entrepreneurs respond to the Silicon Valley Bank collapse and its impact on minority entrepreneurs?

In response to the Silicon Valley Bank collapse, entrepreneurs, particularly those of color, are banding together to support one another. Many have formed networks, such as WhatsApp groups, to share resources and brainstorm funding solutions. This collective action aims to address the financial void left by SVB and reaffirm the commitment to support minority business owners in overcoming funding disparities.

What does the future hold for entrepreneurs of color after the Silicon Valley Bank collapse?

While the Silicon Valley Bank collapse poses challenges for entrepreneurs of color, industry experts remain hopeful. The rise of community banks and fintech solutions may offer new avenues for funding. Continued advocacy for equitable lending will be crucial in addressing the systemic disparities and ensuring that minority entrepreneurs receive the support they need to thrive in the business world.

| Key Point | Details |

|---|---|

| Collapse Overview | Silicon Valley Bank collapsed on March 10 after depositors withdrew $42 billion in one day. |

| Impact on Entrepreneurs of Color | The collapse has raised concerns about reduced funding opportunities for people of color, particularly startup founders. |

| Historical Importance | Founded in 1983, SVB supported nearly half of all venture-backed tech companies in the U.S. and was dedicated to fostering minority entrepreneurship. |

| Responses from Entrepreneurs | Entrepreneurs like Arlan Hamilton and Asya Bradley are mobilizing support in the wake of SVB’s collapse, highlighting reliance on community banks. |

| Disparities in Funding | Discriminatory lending practices limit access to capital for minority business owners, with only 16% of Black-led businesses receiving full funding. |

| Future Outlook | Experts believe community banks and fintech companies may help fill the funding gap left by SVB’s failure. |

Summary

The collapse of Silicon Valley Bank has reignited discussions about the disparities affecting entrepreneurs of color, highlighting the critical funding gap that minority business owners face. As influential figures like Arlan Hamilton point out, the challenges are exacerbated by the systemic inequities in the banking sector. With the bank’s demise, there is urgent concern about the future of funding availability for these entrepreneurs, making it essential for community banks and fintech solutions to step up and provide the necessary financial support.