You’re reading this week’s edition of the New Cannabis Ventures weekly newsletter, which we have been publishing since October 2015. The newsletter includes unique insight to help our readers stay ahead of the curve as well as links to the week’s most important news. We no longer send these by email as we did in the past, but we post this and all of the newsletters on our website here.

Friends,

Cannabis stocks have soared on the news that the federal government may reschedule cannabis, which was revealed on Friday at 9PM ET by the Wall Street Journal and reconfirmed on Monday at a press conference with the President. The New Cannabis Ventures Global Cannabis Stock Index, which closed last night at 7.10, is now up 3.2% year-to-date, but big ETF MSOS, which closed at 5.21, is up a lot more. In Q3, the GCSI is up 41.4% and MSOS is up 116.2%.

Regular readers are likely well aware of how big rescheduling could ultimately be. There are a lot of positives, but the main one for investors is the potential end of an issue we have discussed at length in this newsletter since the end of 2022, 280E taxation. Since the early 1980s, producing or selling drugs that are Schedule 1, like cannabis, or Schedule 2 requires the payment of a tax on gross profits rather than net income. I think that Green Thumb Industries has the best balance sheet among the five largest MSOs, and its last 10-Q reported an effective tax-rate of 96.7% for Q2 and 85.3% for the first two quarters of the year, which is up from 55.1% for the first half of 2024. The actual taxes they paid were $14.7 million for the past six months compared to paying $52.9 million a year ago.

GTI is in much better shape than its peers, with just a small amount of net debt. It will benefit greatly from 280E taxation going away, but its peers will benefit more, as many are struggling with debt. AYR Wellness is liquidating its assets due to its high debt, but it was a Tier 2 name and not Tier 1, which includes GTI and also Curaleaf, Trulieve, Verano and Cresco Labs. For those investing in MSOS, their exposure to these five stocks represents 81.7% of the fund, with almost 70% in the top 3 names:

Former President Biden worked on rescheduling, but it never came to pass. It did send cannabis stocks, especially the MSOs, soaring. The news first hit in late August of 2023 that his Department of Health & Human Services was recommending to the DEA that it move cannabis from Schedule 1 to Schedule 3. On 4/30/24, eight months later, the DEA said that it was going to start the process to do that. Cannabis stocks hit their peaks that day, with the Global Cannabis Stock Index closing at X and MSOS closing at X. The lows for these were set in April of this year and were much lower.

Perhaps the Trump Administration will deliver rescheduling. It still is not known, but the President said that a decision would be made within weeks. It makes great sense that cannabis not be Schedule 1, and there are several benefits to rescheduling, including lower stigma and more research. Americans for Safe Access continues to push for a legal federal national medical cannabis program that I detailed earlier this year, and perhaps this will happen too.

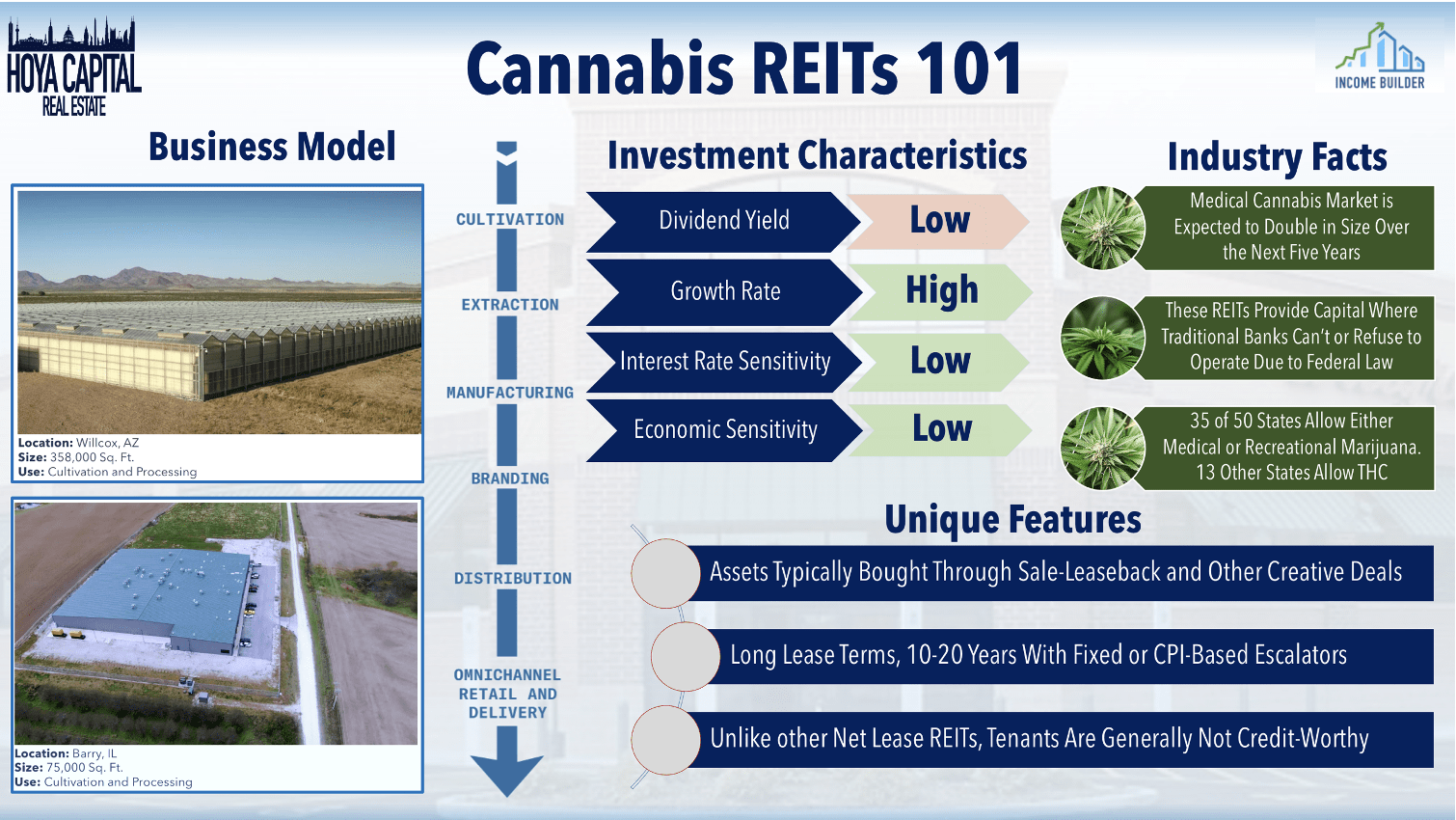

My concerns for the MSOs if 280E sticks around are high, including more potential bankruptcies. I have no exposure to MSOs in my model portfolio at 420 Investor currently, but I do have about 70% exposure to ancillary companies, which is more than double their weight in the index. I hold 4 names currently, including one that I added this week, a cannabis REIT. I added Chicago Atlantic Real Estate Finance because I could not add to my position in IIPR due to its position size being so big at the time. I continue to write articles at Seeking Alpha, which published my Strong Buy article on IIPR this past weekend. My view is due to its low valuation, though it and its peers do face risks if 280E stays around.

There are four publicly-traded cannabis REITs, including IIPR and REFI, which are on my Focus List, and Advanced Flower Group and NewLake Capital, which are not. Three (not NewLake) are in the index that I aim to beat (and am beating!), and they currently represent 9.3%. My REIT exposure is currently higher, at 30.9%. The two REITs in my model portfolio trade on higher exchanges, don’t pay 280E taxation, have better access to capital and trade at or below tangible book value. The top 5 MSOs have negative tangible book value, except for GTI. Here is a chart of MSOS and the four cannabis REITs:

This performance is just price. On a total return basis, the REITs have better total returns due to their big dividends but are all still negative year-to-date. MSOS, then, is up much more than these cannabis REITs and even the Global Cannabis Stock Index over the last month and a half and year-to-date.

I last wrote about the cannabis REITs here in this newsletter in early June, warning that things had been rough for them. I concluded that unless 280E goes away, investors should remain cautious on them. MSOS has soared since then, while these are roughly unchanged for the most part, though one has dropped a lot:

During the whole run up into April 2024, I was cautious on rescheduling. I never used this newsletter to instruct buying aggressively. I always warned, even as I was becoming more optimistic, that rescheduling was not a done deal. It still is not. In fact, I warned very aggressively at the top on May 2nd (a Sunday after the close on 4/30/24), questioning the move higher:

The closing today is very similar in sentiment, though prices are much lower today as the bear market has extended to more than four years now. Rescheduling could be very helpful if 280E taxation goes away, but it is not time to go all-in on cannabis stocks. For those who want to be in, I think that ancillary stocks, including the REITs, do make sense, though if 280E fails, there is a likelihood that they could face pressure.

I continue to be very cautious on the MSOs and think that investors should exit MSOS and each of the three large MSOs it holds too. There are better ways to invest in cannabis. Yes, the REITs do have some potential downside, but I think a lot less than the MSOs. If 280E goes away, many MSOs will likely be selling equity to fix their balance sheets, and this could be a chance to get in. Also, our federal government may need to replace 280E with an excise tax, which would be more fair and less punitive but still a challenge. I am rooting for rescheduling and for 280E taxation to end, but it is difficult to assess this outcome and dangerous to just assume it will pass.

Sincerely,

Alan

New Cannabis Ventures publishes curated articles as well as exclusive news. Here is what we published this past week:

Exclusives

Q2 Cannabis Financial Updates Fail to Impress

Capital Raises

Cresco Labs Extends Debt With $325 Million at 12.5% Due in 2030

Financial Reports

Cresco Labs Reports 11% Q2 Revenue Decline

Verano Q2 Revenue Falls 9%

To get real-time updates, like our Facebook page, or follow Alan on Twitter. Share and discover industry news with like-minded people on the largest cannabis investor and entrepreneur group on LinkedIn.

View the Public Cannabis Company Revenue & Income Tracker, which ranks the top revenue producing cannabis stocks.

Stay on top of some of the most important communications from public companies by viewing upcoming cannabis investor calendar.