In March, retail spending experienced a notable decline, prompting concerns among analysts about consumer behavior and potential recession obstacles. The Commerce Department reported a 1% decrease in retail sales, a sharper drop than the expected 0.4% decline, underscoring fears about a consumer spending recession amidst a shaky economic outlook. This downturn can be largely attributed to smaller tax refunds impacting consumer confidence and spending habits. With tax refunds totaling $84 billion—$25 billion less than the previous year’s figures—many shoppers tightened their wallets, leading to significant drops in spending on department stores and durable goods. As economists analyze the trends in labor market dynamics and retail sales decline, the broader implications point to a cautious financial landscape ahead.

March’s consumer expenditures showcased a shift, with shoppers displaying a reticence to spend amidst fluctuating economic signals and shrinking tax rebates. The noticeable contraction in retail sales, characterized by reduced outlays on essential goods and discretionary items, highlights an overarching anxiety regarding economic stability. With tax refunds failing to meet expectations and concerns about job market resilience, many consumers are adjusting their financial strategies. This hesitance in spending is indicative of broader economic sentiment, where consumer outlook is influenced by tax cycles and labor market fluctuations. Overall, the nuances in March’s retail dynamics reflect a complex interplay of financial factors shaping consumers’ purchase decisions.

March Retail Spending Trends

Retail spending in March took a significant hit, with data revealing a 1% decrease compared to February, surpassing economists’ predictions of a 0.4% decline. This downturn coupled with a revised drop of 0.2% in February suggests a concerning trend in consumer behavior, particularly in a climate shaped by recession fears. The declining consumer confidence has been attributed to various factors, including disappointing tax refunds and anxieties regarding the labor market’s stability. As the economy faces potential stress, the reduction in retail spending is a critical indicator of consumer sentiment.

In addition to the decline in overall retail figures, specific sectors experienced even sharper reductions. For instance, spending at general merchandise stores fell by a notable 3%, and gas station sales decreased by 5.5%. The impact of reduced tax refunds cannot be overstated, as consumers are re-evaluating their expenditures in light of shrinking disposable income caused by the ongoing economic uncertainty. As we analyze the economic outlook for March, it becomes evident that consumers are prioritizing essential purchases, limiting discretionary spending as they navigate this challenging environment.

The Impact of Tax Refunds on Consumer Spending

March is typically a crucial month for tax refunds, influencing consumer spending patterns significantly. The IRS reported issuing $84 billion in tax refunds for March, marking a $25 billion drop from the previous year. This substantial decline has directly contributed to the downward shift in retail spending as consumers adjusted their budgets in light of smaller-than-expected refunds. This phenomenon not only impacts retailers’ performance but also highlights the delicate balance of consumer finances against the backdrop of an impending recession.

Financial analysts emphasize that the decrease in tax refunds is compounded by other factors, such as the expiration of additional food assistance benefits, further straining household budgets. The expectation of higher tax refunds compared to last year left many consumers disappointed, which in turn curbed their willingness to spend on non-essential items. With retail sales reflecting these shifts, the insights from March serve as a bellwether for future consumer behavior and the overall economic trajectory.

Consumer Spending Recession Concerns

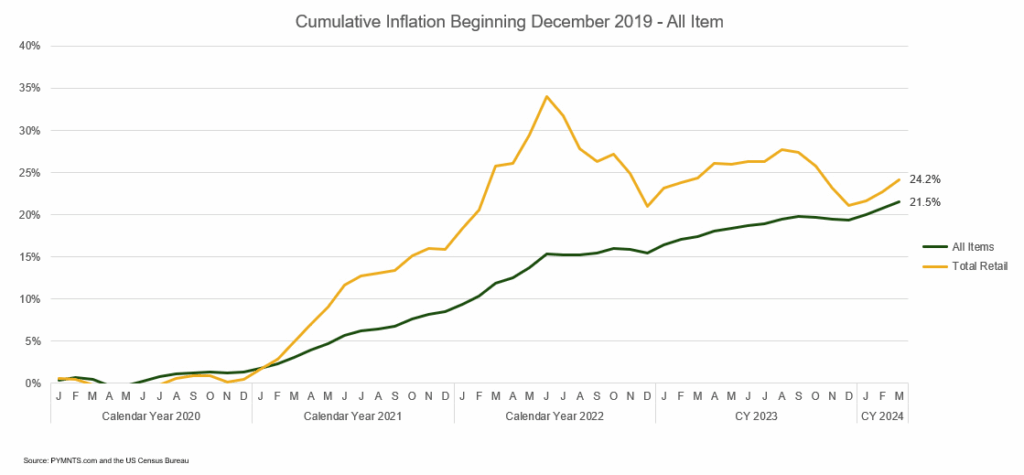

As fears of a consumer spending recession intensify, recent data underscores the precariousness of the current economic landscape. The drop in retail spending is particularly concerning as it coincides with rising inflation expectations and a cooling labor market. Analysts warn that a prolonged decline in consumer confidence could exacerbate existing economic challenges, leading to a more pronounced recession. The interplay between labor market trends, consumer behavior, and economic policies will be critical in navigating this turbulent period.

The prevailing sentiment among economists is that without a rebound in consumer spending, the repercussions could ripple across various sectors, resulting in broader economic implications. The Federal Reserve is closely monitoring these trends, which are being driven by fears related to inflation and interest rates, both of which are known to dictate consumer spending behaviors. If consumers continue to hesitate in their spending due to economic uncertainties, the chances of slipping into a full-blown recession become increasingly likely.

Labor Market Trends and Their Influence on Spending

March’s employment report revealed the addition of 236,000 jobs, signaling robust growth, although this figure fell short of the average monthly gains seen over the preceding six months. The cooling labor market adds to the complexities of consumer sentiment and spending patterns. Analysts note that job availability, which remains high despite a decrease from peak levels, could be affecting how consumers perceive their financial security and potential expenditures in the context of the current economic climate.

With wage growth also showing signs of deceleration, as evidenced by the smallest annual increase since June 2021, consumers may be feeling the strain of a tightening job market. Therefore, as disposable income stagnates and inflation continues to erode purchasing power, consumer confidence in spending may be undermined in the months ahead. The interplay of labor market trends with consumer behavior will be crucial for tracking the trajectory of the economy, particularly in relation to retail spending.

Economic Outlook for March and Beyond

The economic outlook for March reveals a landscape fraught with uncertainty, characterized by a mix of consumer resilience and underlying fears of a recession. While retail spending did post a year-over-year increase of 2.9%, the overall data point to weakened consumer confidence and slowing economic activity. This ambivalence is intensified by external factors such as rising interest rates and the recent banking crisis, which have dampened consumer sentiment and spending.

Despite cooler economic indicators, economists like Michelle Meyer from Mastercard Economics Institute maintain that the foundational elements supporting consumer health remain intact. Income growth, healthy balance sheets, and a persistent labor market dynamic have helped sustain consumer spending, albeit cautiously. However, as inflation pressures rise and expectations shift, the groundwork for a sustained recovery becomes increasingly tenuous, demanding close attention from analysts and policymakers alike.

The Role of Consumer Sentiment in Retail Spending

Consumer sentiment is a pivotal factor determining retail spending patterns. The slight dip observed in consumer sentiment indices, despite showing stability in recent reports, indicates a cautious public mood amidst economic turbulence. Surveys conducted by institutions such as the University of Michigan highlight that while consumers are anticipating potential economic downturns, there is a less bleak outlook compared to last year. This nuanced sentiment could influence future retail spending behaviors, as consumers reassess their priorities.

As consumers navigate their expectations against the backdrop of economic uncertainties, their spending habits reflect a growing wariness. The increase in gas prices has further heightened inflation concerns, prompting consumers to be more selective with their spending. Understanding the dynamics of consumer sentiment and its direct correlation with retail spending is essential for retailers and economists as they strategize for resilience in a potentially shifting landscape.

Banking Crisis and Its Impact on Consumer Behavior

The recent banking crisis has left a noteworthy imprint on consumer behavior, nudging individuals toward caution in their spending decisions. Despite the economic fundamentals appearing relatively strong, fear stemming from banking instability has caused many consumers to tighten their purse strings, influencing the overall retail spending landscape. As evidenced by the substantial decrease in retail sales across various sectors, the psychological effects of such crises can lead to significant shifts in consumer confidence.

Analysts continue to monitor the implications of the banking crisis on consumer spending, positing that the aftermath could linger longer than anticipated. With preliminary data indicating a slowdown in credit and debit spending, experts underscore the importance of addressing consumer fears to revitalize confidence. How consumers adapt to these uncertainties will crucially shape retail spending trends in upcoming months.

Anticipating Future Economic Trends

Looking ahead, understanding consumer behavior and retail spending patterns will be integral to forecasting economic trends. With economic signals suggesting potential recessions, analysts urge a careful examination of spending habits and economic policies. The trajectory of retail sales, influenced by an array of factors including tax refunds and labor market dynamics, will inform predictions for future economic performance and consumer behavior.

The ability of consumers to adapt to changing economic conditions will play a decisive role in determining retail spending levels in the face of evolving challenges. Policymakers and retailers alike must remain agile and responsive as consumer preferences shift. Anticipating these future trends can provide valuable insights into maintaining economic stability and mitigating the risks of a prolonged recession.

Frequently Asked Questions

What factors contributed to the decline in March retail spending?

The decline in March retail spending can be attributed to several key factors, including a 1% decrease in retail sales due to recession fears triggered by a recent banking crisis. Additionally, smaller tax refunds, decreased consumer spending at department stores, and a cooling labor market all impacted retail figures. Analysts noted the importance of tax refunds in consumer spending patterns during this critical month.

How have tax refunds impacted consumer spending in March?

In March, the IRS issued $84 billion in tax refunds, which was about $25 billion less than the same month in 2022. This decline in tax refunds significantly impacted consumer spending, leading to reductions in spending at various retail sectors, including a 3% drop at general merchandise stores. Many consumers had anticipated larger tax refunds based on previous years, affecting their overall spending behavior.

What is the current economic outlook for March in terms of retail sales?

The economic outlook for March indicates a challenging environment for retail sales, as retail spending fell by 1% amid recession fears. Factors such as smaller tax refunds, rising inflation expectations, and a cooling labor market contribute to this outlook. While year-over-year retail spending has increased by 2.9%, the month-to-month decline highlights concerns about consumer confidence in the economy.

How does the labor market trend affect March retail spending?

The trends in the labor market significantly impact March retail spending, as a slowdown in wage growth and an increase in unemployment claims may reduce consumer purchasing power. Despite adding 236,000 jobs in March, the employment figures show a decline from previous months, which can create uncertainty among consumers regarding their spending habits, ultimately leading to reduced retail sales.

Will the recent banking crisis affect consumer sentiment in March?

Yes, the recent banking crisis has affected consumer sentiment in March, leading to a slight dip in indices that measure consumer outlook. Although consumers did not perceive significant changes in their economic environment overall, concerns about a potential downturn have emerged. Consumers are wary but not as pessimistic as in previous months, indicating cautious optimism moving forward.

What is the significance of retail sales decline in March in relation to the overall economy?

The retail sales decline in March is significant as it reflects broader economic challenges, including reduced consumer spending amid recession fears and the impact of smaller tax refunds. Such declines can signal sluggish economic health, influencing how businesses and policymakers respond to stimulus measures and economic recovery efforts moving into the year.

| Key Point | Details |

|---|---|

| March Retail Spending Decline | Retail spending fell by 1% in March compared to February. |

| Economic Concerns | Consumer withdrawal linked to recession fears due to a banking crisis. |

| Tax Refunds Impact | IRS issued $84 billion in tax refunds, down $25 billion from March 2022. |

| Sector-Specific Decrease | Spending fell 3% at general merchandise stores, 5.5% at gas stations. |

| Consumer Spending Trends | Household spending on cards at slowest pace in two years. |

| Wage Growth | Average hourly earnings increased by 4.2% year-over-year. |

| Job Market Status | 236,000 jobs added in March; job availability down 17% since peak. |

| Economic Outlook | Federal Reserve forecasts subdued growth; concerns of recession remain. |

Summary

March retail spending experienced a significant decline as consumers faced recession fears exacerbated by the recent banking crisis. The 1% drop in retail sales, coupled with reduced tax refunds and a cooling labor market, underscored the challenges facing the economy. While there was a year-over-year increase of 2.9% in retail spending, recent trends show a cautious outlook for consumer behavior ahead. With economists predicting further cooling in the job market due to rising interest rates, the potential for a recession looms large, impacting overall March retail spending.