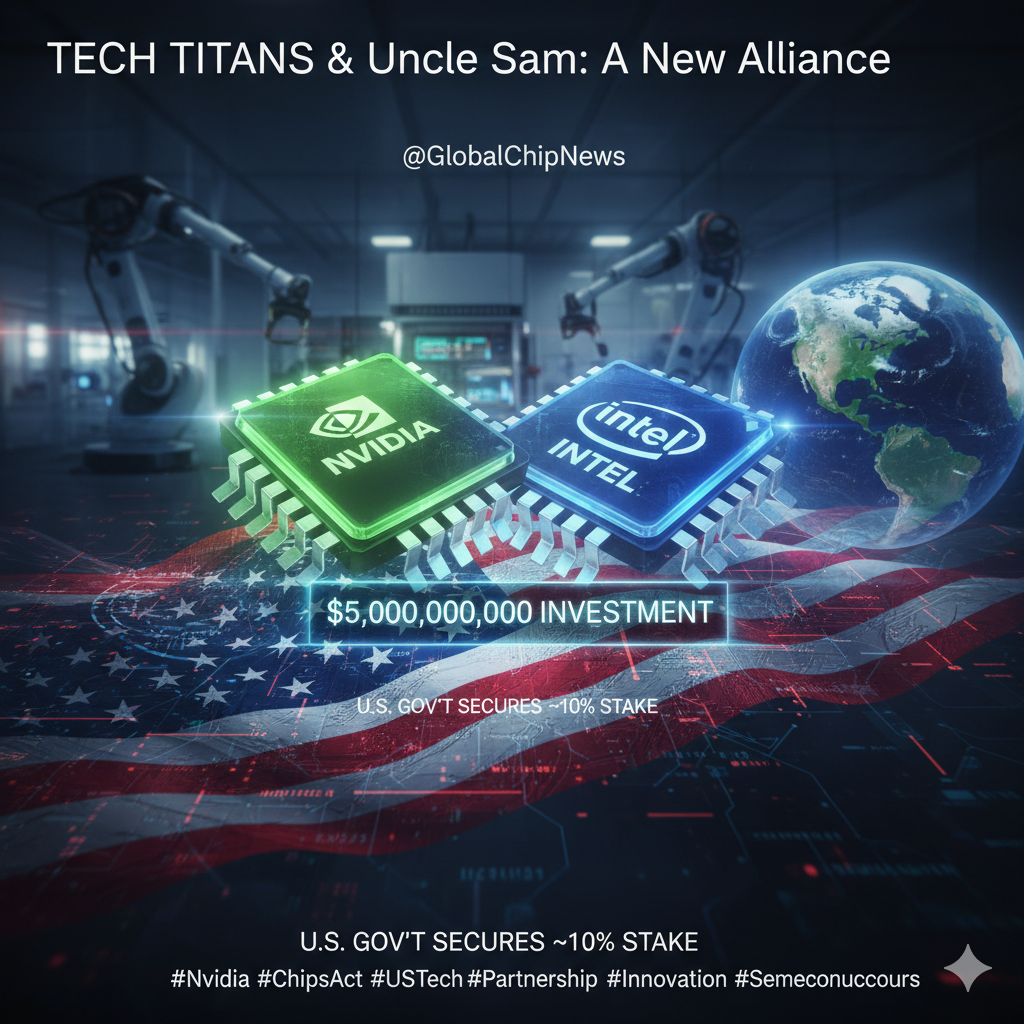

The global semiconductor industry has been rocked by a dramatic turn of events, with Nvidia, the world’s leading chipmaker, announcing a significant $5 billion investment in its rival, Intel. This move, which comes alongside a new collaboration, signals a major shift in the technological landscape and highlights the increasing importance of domestic chip production in the United States.

On Thursday, September 18, 2025, Nvidia revealed its plan to purchase Intel common stock, sending Intel’s shares soaring by nearly 23%, their biggest single-day percentage gain since 1987. Nvidia’s own stock also saw a boost, adding more than 3% and briefly pushing its market value to a staggering $4 trillion, making it the world’s second most valuable company.

This partnership, which has been described as a “lifeline” for Intel, will see the two companies work together on new chip designs. For data centers, Intel will manufacture custom chips for Nvidia’s AI infrastructure platforms. For personal computing, Intel will integrate Nvidia’s technology into its own chips. This collaboration is a recognition that the era of AI and accelerated computing has arrived, with Nvidia’s CEO Jensen Huang stating that “computing has fundamentally changed.”

The deal is a testament to the immense power shift that has occurred in the tech industry. As recently as 2022, Intel had double the revenue of Nvidia, but the latter’s dominance in the AI market, driven by demand for its graphics processing units (GPUs), has led to a market value that dwarfs Intel’s. While the two companies will collaborate on new chips, a manufacturing deal has yet to be finalized. However, the potential for Nvidia to gain access to Intel’s foundries poses a risk to Taiwan Semiconductor Manufacturing Company (TSMC), which currently manufactures Nvidia’s flagship processors.

The U.S. Government’s Stake in Intel

The Nvidia investment is the latest in a series of financial lifelines for Intel, and it comes on the heels of a monumental development: the U.S. government has also acquired a significant stake in the company.

In a rare and unprecedented move, the Trump administration announced in late August 2025 that it had secured a nearly 10% ownership stake in Intel. This investment, valued at $8.9 billion, was made by converting a portion of previously awarded grants from the U.S. CHIPS and Science Act and funding from the Secure Enclave program. The total government investment in Intel now stands at $11.1 billion.

The primary interest of the American state in Intel is to bolster domestic semiconductor manufacturing and reduce the country’s reliance on foreign supply chains, particularly from Asia. The CHIPS and Science Act, passed under the Biden administration, was designed to incentivize companies like Intel to build and expand chip fabrication plants in the U.S. By taking a direct ownership stake, the government is not only providing financial support but also signaling its commitment to ensuring a secure and resilient domestic semiconductor industry.

While the government’s stake is “passive,” meaning it holds no board representation or voting rights, it represents a new and controversial level of public-private sector integration. Critics of the deal have expressed concerns that such intervention could undermine free enterprise and politicize the tech industry. However, the government’s investment is seen by many as a necessary step to protect a critical national asset and ensure U.S. technological leadership in an increasingly competitive global landscape.

This confluence of events—Nvidia’s strategic investment and the U.S. government’s unprecedented ownership stake—underscores Intel’s critical role in both the commercial and national security interests of the United States. It highlights a future where collaboration, rather than pure competition, may be the key to maintaining a technological edge, and where the state’s role in the private sector is becoming more pronounced than ever before.

Sources:

- Associated Press. (2025, September 18). Nvidia to invest $5 billion in struggling rival Intel. AP News.

- Al Jazeera. (2025, August 28). Intel receives $5.7bn as Trump administration buys 10 percent stake. Al Jazeera.

- Manufacturing Dive. (2025, August 25). US government to take 10% stake in Intel with CHIPS funding. Manufacturing Dive.

- The Guardian. (2025, September 18). Nvidia to invest $5bn in Intel after Trump administration’s 10% stake. The Guardian.

- Intel Newsroom. (2025, August 22). Intel and Trump Administration Reach Historic Agreement to Accelerate American Technology and Manufacturing Leadership. Intel.com.