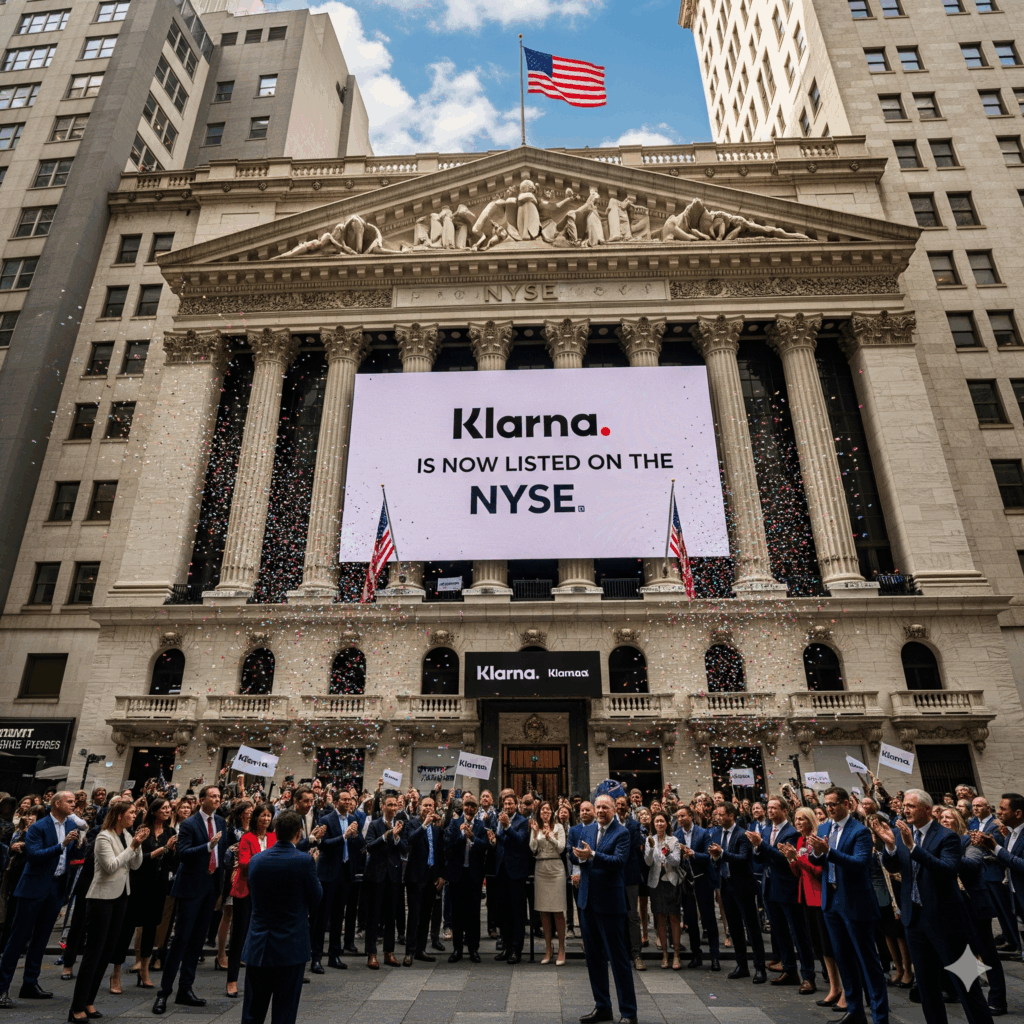

New York, NY – September 10, 2025 — Swedish fintech powerhouse Klarna made its long-awaited debut on the New York Stock Exchange this week, marking a pivotal moment in the evolution of the global buy-now-pay-later (BNPL) industry. With shares opening at $52—well above the IPO price of $40—the company surged 30% before settling at $45.82, giving Klarna a market valuation of approximately $17.3 billion.

This IPO not only signals Klarna’s ambitions to deepen its footprint in the United States, but also reflects the company’s resilience and dominance in Europe, where it has become a household name in digital payments and e-commerce.

Klarna’s European Success: A Fintech Blueprint

Founded in 2005 by three Swedish students, Klarna revolutionized online shopping with its “try before you buy” model. Over the past two decades, it has evolved into a full-fledged financial services platform, serving over 111 million consumers across 26 countries. Klarna’s European growth has been nothing short of phenomenal:

- GMV Growth: Klarna reported a 14% year-over-year increase in Gross Merchandise Volume (GMV) in Q2 2023, outpacing the broader e-commerce sector which grew by just 1%.

- Merchant Network: The company partners with over 470,000 merchants, including iconic brands like Nike, H&M, ASOS, and Samsung.

- Consumer Loyalty: A Klarna survey revealed that 74% of European users shop with Klarna at least once a month, citing trust and ease of payment as key drivers.

Klarna’s success in Europe stems from its ability to navigate complex regulatory environments and tailor its offerings to diverse markets. Its “Pay Now” option—allowing immediate payment without interest—has gained traction across the continent, accounting for nearly a third of all transactions.

🇺🇸 Klarna in the U.S.: A Market of Opportunity and Challenge

Klarna entered the U.S. market in 2015 through a partnership with Macy’s. Since then, it has expanded aggressively, striking deals with Walmart, eBay, and other major retailers. The company now boasts 700,000 U.S. debit card customers and a waiting list of 5 million for its newly launched Klarna Card.

Despite these milestones, Klarna faces stiff competition from Affirm and Afterpay. Affirm, for instance, commands a $28 billion valuation and has focused on big-ticket financing, whereas Klarna’s average order value is $101—suggesting a focus on everyday purchases.

Klarna’s U.S. strategy hinges on becoming an “everyday spending partner,” offering flexible payment options and embedding itself into consumer habits. Its partnerships with payment processors like Stripe and Worldpay aim to make Klarna a default checkout option, not just an add-on.

Bullish or Bearish? The Investment Case

Bullish Signals:

- Strong IPO Performance: Klarna’s IPO was oversubscribed, with shares priced above the expected range and a first-day pop of 30%.

- Global Reach: Klarna’s presence in 26 countries and partnerships with nearly half a million merchants provide a diversified revenue base.

- Consumer Trends: BNPL is gaining traction as consumers seek alternatives to credit cards amid economic uncertainty. Klarna’s short-term lending model offers flexibility without revolving debt.

- Tech Integration: Klarna’s AI-powered recommendation engine and integration with ChatGPT signal its commitment to innovation.

Bearish Concerns:

- Profitability Pressure: Klarna posted a $100 million net loss in the last fiscal year, compared to Affirm’s $52 million net income.

- Regulatory Scrutiny: BNPL products are under increasing regulatory watch, especially in the U.K. and U.S., due to concerns about consumer overextension.

- Valuation Compression: Klarna’s current valuation of $17.3 billion is a steep drop from its $45.6 billion peak in 2021, raising questions about long-term investor confidence.

Verdict: A Cautiously Bullish Outlook

Klarna’s IPO is a bold statement of intent. It’s not just a liquidity event—it’s a strategic pivot toward global dominance. The company’s European success provides a strong foundation, and its U.S. expansion is gaining momentum. However, profitability and regulatory clarity will be key to sustaining investor enthusiasm.

For now, Klarna offers a compelling growth story in a sector that’s reshaping consumer finance. Whether it becomes the next PayPal or fades into fintech obscurity will depend on its ability to balance innovation with financial discipline.

Disclosure: This article is for informational purposes only and does not constitute financial advice. Klarna is not affiliated with The Cannabis Journal.